A cash balance plan resembles a defined-benefit pension plan where an employee is guaranteed a certain sum of money upon retirement.

This sum is a combination of employer contributions and compound interest over time.

The employee has the option at retirement to either annuitize or takes the benefits at lump sum.

A cash balance plan works almost similar to a defined-benefit pension plan in that its funding limits, funding requirements, and assumption of risks are patterned after the same rules.

A key difference is that cash balance plans are maintained on an individual account basis just like 401(k) plans.

With this, benefits are not directly affected by increases or decreases in the plan’s investment value.

A cash balance plan also carries a definite balance that can be rolled over or taken as cash payment at retirement.

Like other employer-sponsored retirement schemes, the Employee Retirement Income Security Act (ERISA) governs cash balance pension programs.

The Age Discrimination in Employment Act (ADEA) and the Internal Revenue Code (IRC) also regulate these plans.

Most cash balance plans' benefits are insured by the Pension Benefit Guaranty Corporation (PBGC).

There are no employee contributions in a cash balance plan.

The employer contributes to each employee's account when a company offers a cash balance plan.

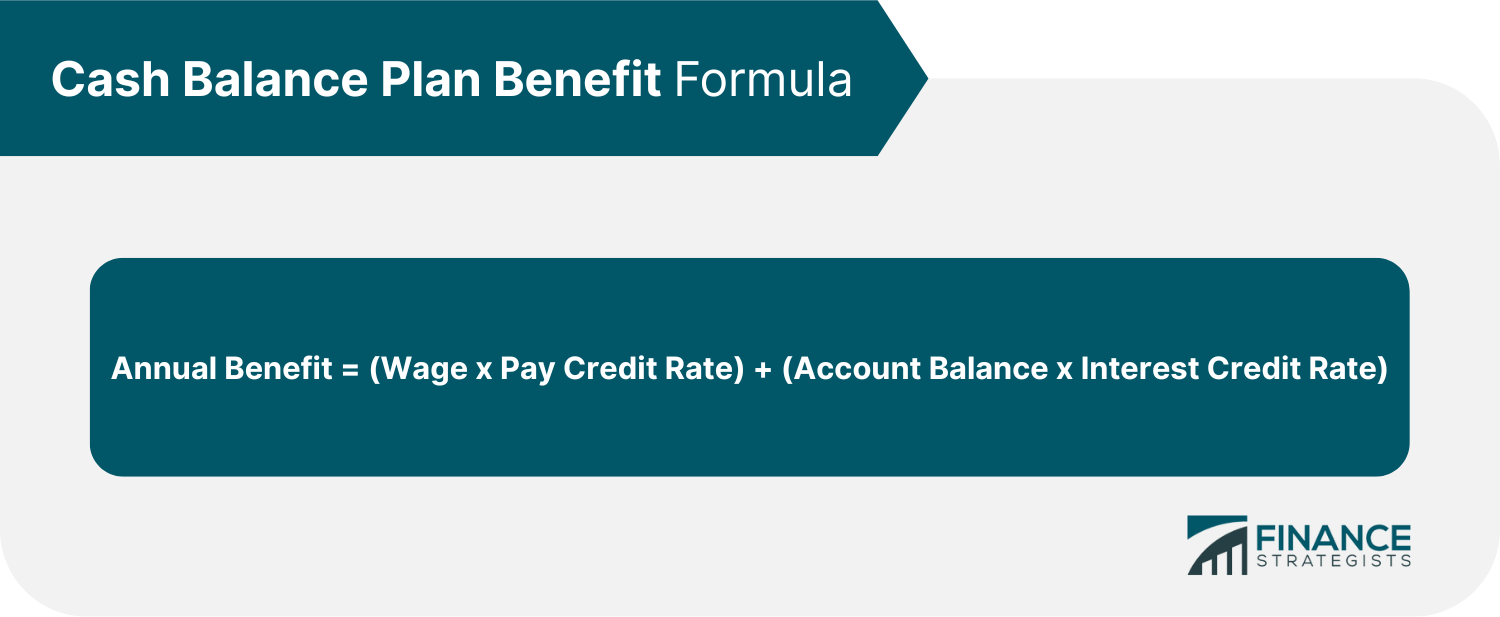

For each year that an employee stays with the company, his account will be funded with a pay credit and an interest credit each year based on the following formula:

Wage refers to the employee’s salary. The pay credit is often a percentage of the employee’s wage which typically ranges from 5% to 8%.

Account balance refers to the accumulated balance of benefits and earnings.

The interest credit rate is a percentage that the employer chooses as a basis for the growth of contributions over time.

This figure can either be a fixed rate or a variable rate such as one that is tied to, say, for example, the interest rate on 30-year Treasury bonds.

An employee about to retire can take the sum as a lump amount or commit to an annuity that compensates a portion of the total in periodic payments.

A plan actuary maintains these accounts and provides annual participant statements.

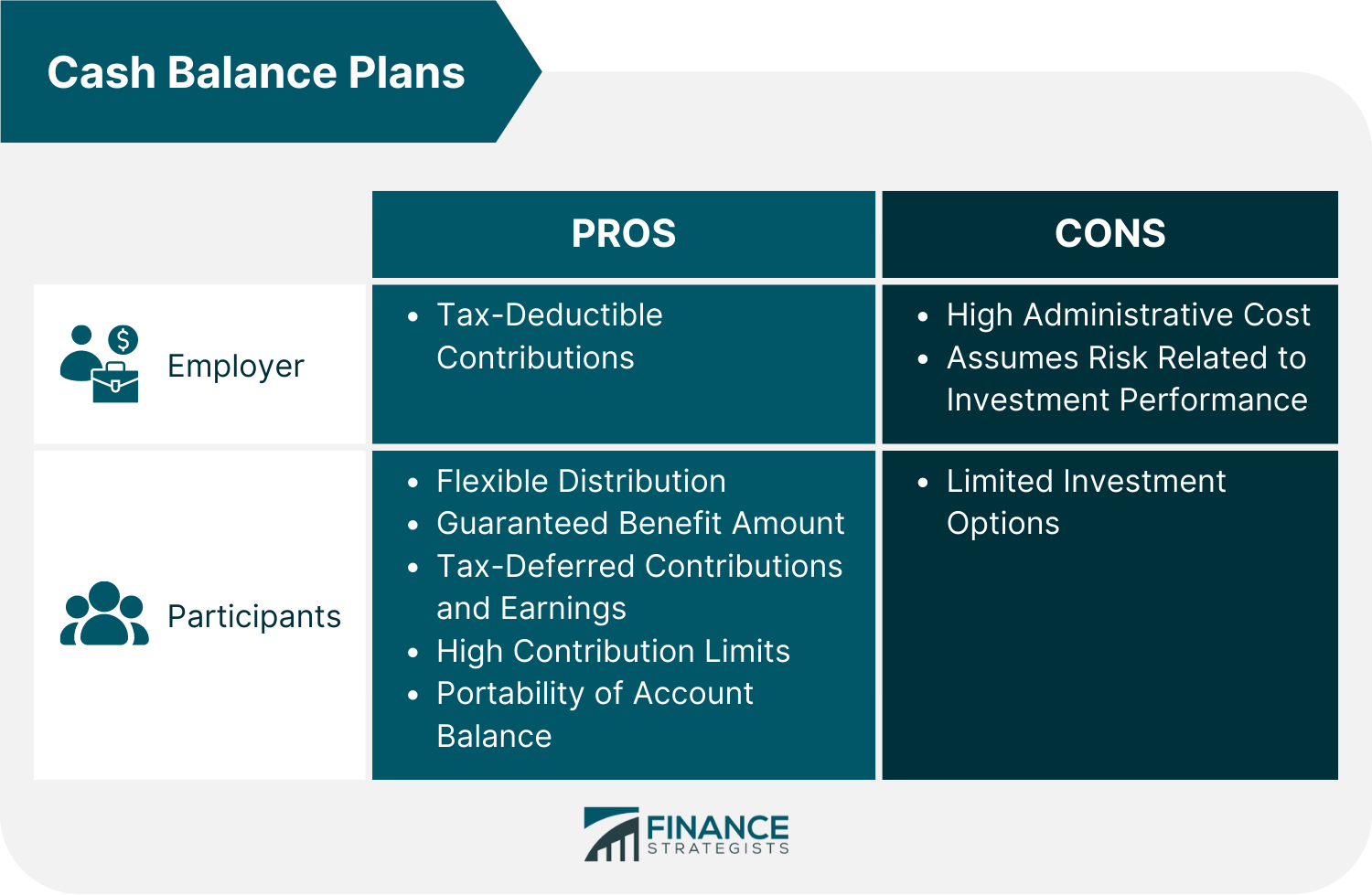

Listed below are some of the key benefits of a cash balance plan:

When an employee retires, they can take the lump sum or commit to an annuity.

This flexibility allows employees to tailor their retirement income to suit their needs.

A lump sum payment can help you pay off huge debts, pass it on as an inheritance, or make an investment.

An annuity will provide a regular income for a lifetime with the possibility of passing it on to your beneficiaries.

Just like a regular defined-benefit plan, the employer provides the employee with a guaranteed set benefit amount in a cash balance plan.

The fund's investment performance does not influence employee benefits because the employer assumes all risks.

Cash balance plans offer the same tax benefits as traditional pension plans.

Contributions and earnings in the account grow tax-deferred, and benefits are taxed as income when received.

Employers may also get a tax deduction for their contributions to the plan.

The contribution limit for cash balance plans is higher than for traditional pension plans and 401(k) plans.

Those who need to make substantial catch-up payments to save for retirement will benefit from this.

Age-based contribution limitations for cash balance plans are up to $275,000 in 2024 for employees over 60. This limit is adjusted for inflation every year.

Employees can take their account balance with them if they leave their job.

Traditional pension plans differ from this, which often have vesting requirements before employees can take their benefits with them.

This portability option enables workers to grow their assets in the plan, where they will continue to get interest credits.

Other options include choosing an annuity or taking a lump sum and rolling over their account balance to their new employer's retirement plan or an IRA.

The PBGC insures participants' benefits in defined-benefit pension plans.

Suppose the employer sponsoring the cash balance plan terminates it or becomes insolvent.

In that case, PBGC will take over and pay participants their benefits up to a maximum amount.

There are some drawbacks to cash balance plans to consider:

Cash balance plans are more expensive to manage than typical pension plans.

They require specific actuarial calculations and employee interactions.

The employer assumes all investment risk in a cash balance plan, so employees have limited investment options.

Typically, the portfolio is invested more cautiously, with a balanced distribution of equities and bonds.

The employer manages cash balance plans, so they bear the investment risk.

The employer must raise payments to cover the deficit if the plan underperforms.

A significant decline in portfolio value might cause issues for the company providing the benefits. Thus, it is essential to minimize this potential.

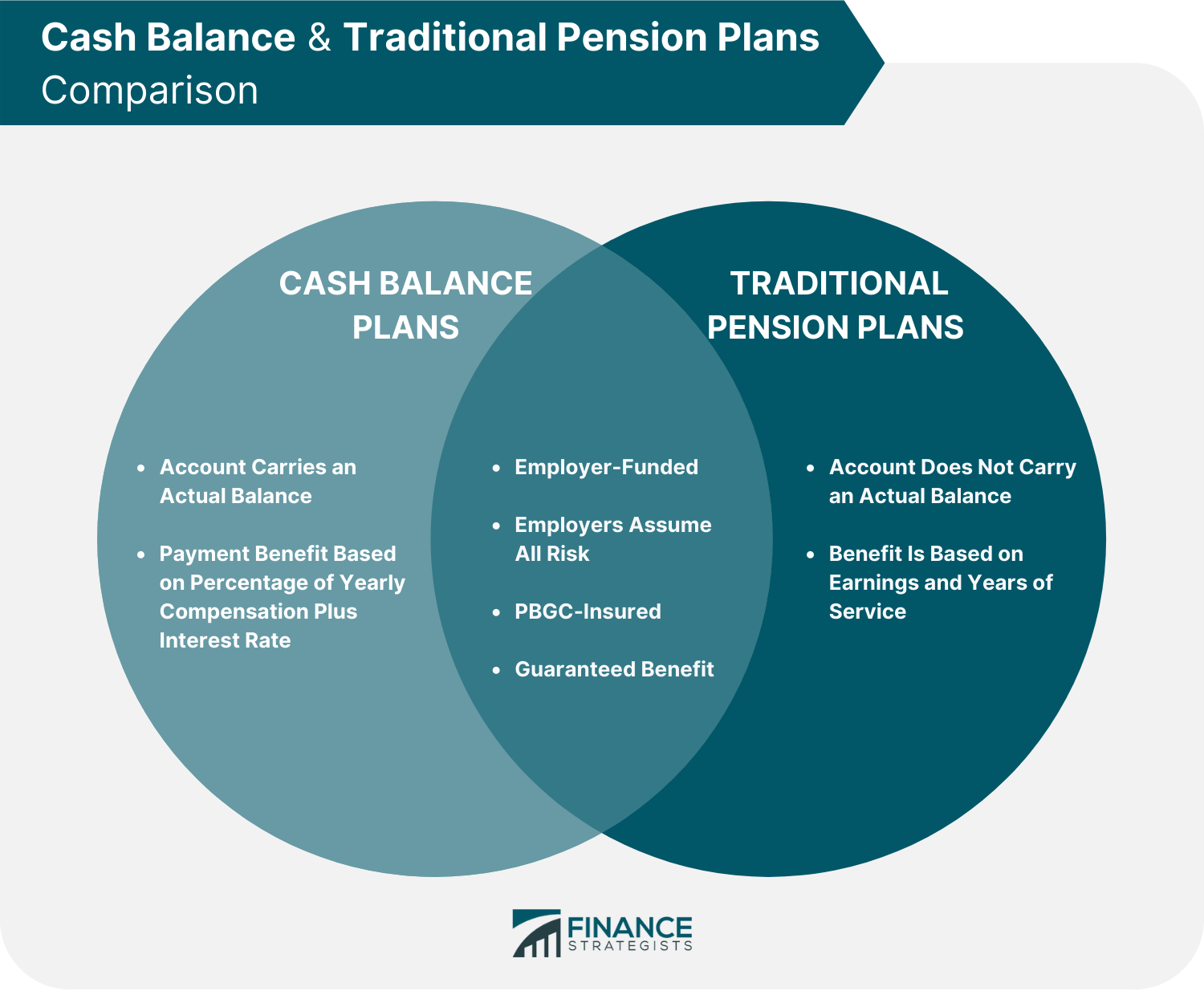

Cash balance plans and traditional pension plans are closely the same in nature in that both plans are funded by the employer.

The employer also bears all investment risks and profits on the plan assets.

Both plans are also favored by most employees because the benefits are guaranteed at retirement. PBGC also covers both plans in case of insolvency.

A key difference between the two plans is the basis of the benefits.

For cash balance plans, the benefit is based on the employee’s yearly wage plus interest.

While for a traditional pension plan, no compounding on benefits applies. Benefits are solely based on wage and years of service.

Also, in a traditional pension plan, the account does not have an actual balance.

Any lump sum payments would be actuarial counterparts to your monthly annuity benefits.

Hence, no balance will be clearly visible to the participant.

A cash balance plan carries an actual balance which means that the participant has the option to roll it over or take it as a lump sum at retirement.

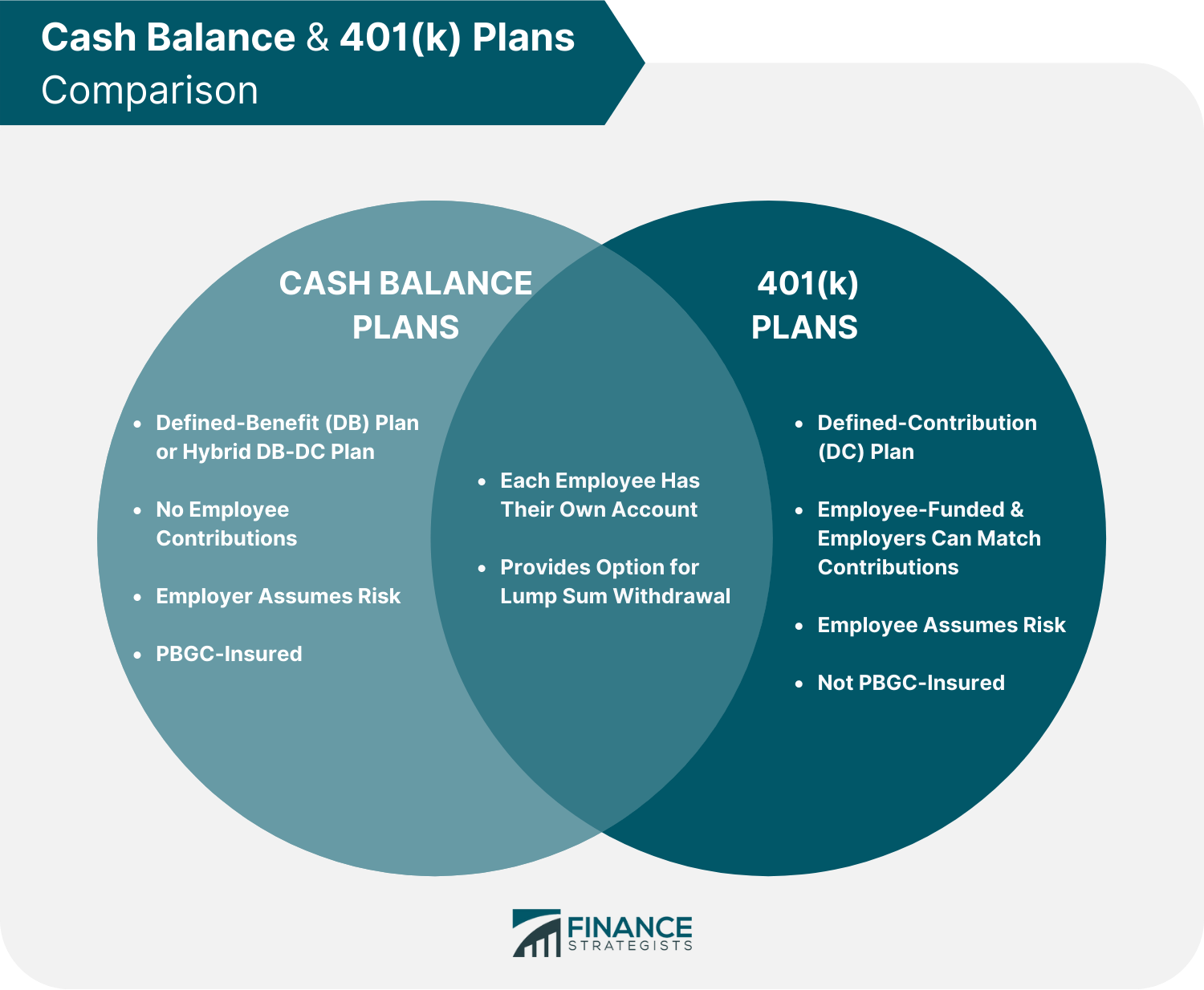

401(k) plans are defined-contribution (DC) plans, whereas cash balance plans are generally defined-benefit (DB) plans and sometimes can also be a hybrid DB-DC plan.

Unlike cash balance plans, employees who have a 401(k) plan mainly fund the account and employers have the option to match their contributions.

In terms of investment risk, the employee assumes the risk in a 401(k) plan.

The employee is at risk of depleting her 401(k) account if the market falls.

While in a cash balance plan, only the employer bears all the risk.

A 401(k) plan is also not covered by PBGC, unlike a cash balance plan.

A similarity of both plans is the availability of the option to take the benefit as a lump sum at retirement.

Both plans are also maintained on an individual account basis.

A 401(k) plan has separate accounts for each employee who wants to contribute.

Each participant in a cash balance plan has a hypothetical account under a trust account.

A cash balance plan promises an employee a set proportion of their yearly earnings, plus interest, to achieve a certain sum by the time they retire.

Each member in a cash balance plan has their own account. The account grows annually in two ways:

Cash balance plans provide assured benefits, flexible distribution alternatives, tax advantages, high contribution limits, portability, and PBGC protection.

However, they can be more expensive due to administrative costs, and the growth of investments is risky for employers.

Get in touch with a retirement planning advisor to know more about how a cash balance plan could work for you and determine which is most suitable for your goals and circumstances.

Ultimately, it depends on your specific financial goals and circumstances. However, cash balance plans can be a good idea for some people, especially those looking for a retirement plan with guaranteed benefits. A cash balance provides a valuable strategy for jump-starting retirement savings or catching up if you are behind your target. Additionally, they are a great way to reduce taxes.

A cash balance plan is an alternative to the traditional pension plan. Similar to a traditional pension, a cash balance plan offers employees the option of a lifetime annuity. Unlike pensions, however, cash balance plans provide an individual account for each participant and a specified total account balance that employees can get when they retire.

Generally, you must wait until retirement age to withdraw funds from a cash balance plan. In contrast to traditional pension plans, cash balance plans are transferable. This implies that you can roll over the vested part into an IRA when you leave an employer, whether freely or involuntarily.

Age-based contribution limitations for cash balance plans are up to $245,000 in 2022 for employees over 60. This limit is adjusted for inflation every year.

Cash balance plans allow for more significant contributions and tax deductions. Stick with the 401(k) if you just want to contribute a small amount, such as $30,000 or less, and you want a simple and inexpensive plan. But if you save more than $100,000 for retirement, choose the cash balance plan.

About the Author

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.

WHY WE RECOMMEND:

Fee-only financial advisors are paid a set fee for their services. They do not receive any type of commission from the sale of products they are advising on.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

WHY WE RECOMMEND:

Fee-only financial advisors are paid a set fee for their services. They do not receive any type of commission from the sale of products they are advising on.

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Content sponsored by 11 Financial LLC. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from 11 Financial upon written request.

11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

© 2024 Finance Strategists. All rights reserved.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.